About the Programme

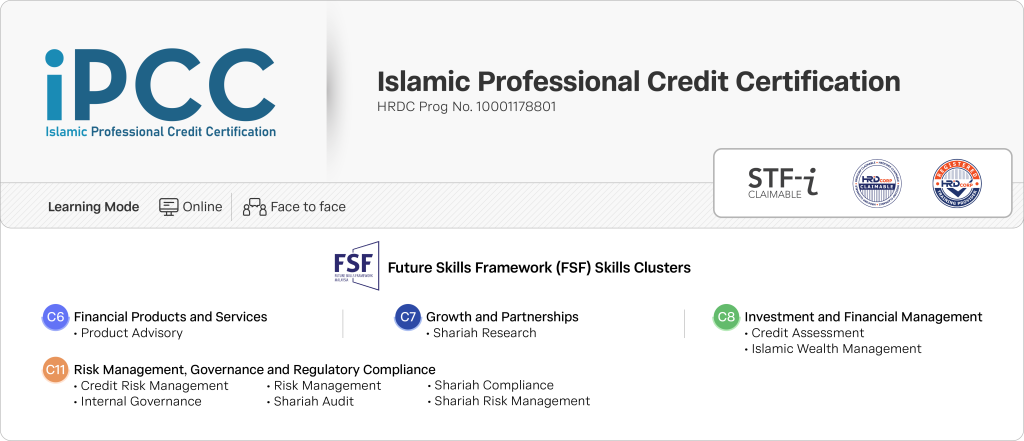

IPCC is designed for banking professionals who seek to equip themselves with the skills, knowledge and tools to advance in the demanding and rapidly changing field of credit management in Islamic Banking. By dedicating time and effort to complete iPCC, learners will demonstrate their commitment towards attaining the highest standards of becoming a credit professional in Islamic Banking.

Learning Outcomes

At the end of the module, learners should be able to:

- Recognise various forms of Muamalat contracts commonly practised in mainstream Islamic products and services;

- Describe the process and procedures in credit management and monitoring financing portfolios within the Islamic retail and business financing environment in Islamic financial institutions;

- Explain the principles and basic financing origination and credit management processes within a financial institution;

- Identify the basic management components in Islamic financial institutions that cover the structural elements, characteristics of banking products, current practices, protocols, and limitations; and

- Outline the main structure and guidelines in preparing good credit reports.

Entry Requirement

- Diploma, or

- Sijil Pelajaran Malaysia (SPM) / O-Level or equivalent with 3 years’ experience in Credit Management or Banking

Assessment

- Level 1 – 100 Multiple Choice Questions | 2 Hours 30 Minutes, 60% Passing Mark

- Level 2 – 60 Multiple Choice Questions, 2 Case Studies | 3 Hours 30 Minutes, 60% Passing Mark

Programme Details

| Programme | Online | Face to face |

| M1 Fundamentals of Shariah for Islamic Finance HRDC Prog No. 10001334036 Fundamental | 21 hours RM 3,220.56 USD 1,065.96 | 3 days RM 4,098.60 USD 1,354.32 |

| M2 Fundamentals in Credit Operation HRDC Prog No. 10001444224 Fundamental | 21 hours RM 3,220.56 USD 1,065.96 | 3 days RM 4,098.60 USD 1,354.32 |

| M3 Islamic Bank Management HRDC Prog No. 10001443295 Intermediate | 21 hours RM 3,402.00 USD 1,134.00 | 3 days RM 4,455.00 USD 1,474.20 |

| M4B Islamic Business Financing Products* HRDC Prog No. 10001443891 Intermediate M4R Islamic Retail Financing Products* HRDC Prog No. 10001443384 Intermediate *R = Retail or *B = Business Note: Participants choose any of the specialisation in iPCC Level 2, M4R or M4B | 21 hours RM 3,402.00 USD 1,134.00 | 3 days RM 4,455.00 USD 1,474.20 |

| Preparatory Class for M1 | 4 hours RM 613.44 USD 203.04 | 0.5 day RM 683.10 USD 225.72 |

| Preparatory Class for M2 | 4 hours RM 613.44 USD 203.04 | 0.5 day RM 683.10 USD 225.72 |

| Preparatory Class for M3 | 4 hours RM 648.00 USD 216.00 | 0.5 day RM 742.50 USD 245.70 |

| Preparatory Class M4B Preparatory Class M4R | 4 hours RM 648.00 USD 216.00 | 0.5 day RM 742.50 USD 245.70 |

| Assessment M1 | 2.5 hours RM 300.00 USD 95.00 | – |

| Assessment M2 | 2.5 hours RM 300.00 USD 95.00 | – |

| Assessment M3 | 3.5 hours RM 400.00 USD 125.00 | – |

| Assessment M4B Assessment M4R | 3.5 hours RM 400.00 USD 125.00 | – |

| TOTAL | 100 hours RM 17,168 USD 5,678.00 | 14 days RM 21,358.40 USD 7,039.88 |

Programme Date

| Modules | COHORT 1 | COHORT 2 | COHORT 3 |

| M1 | 14-16 Apr 2026 | 23-25 Jun 2026 | 13-15 Oct 2026 |

| M2 | 11-13 May 2026 | 21-23 Jul 2026 | 17-19 Nov 2026 |

| M3 | 8-10 Jun 2026 | 18-20 Aug 2026 | 5-7 Jan 2027 |

| M4B | 7-9 Jul 2026 | 28-30 Sep 2026 | 15-17 Feb 2027 |

| M4R | 4-6 Aug 2026 | 27-29 Oct 2026 | 16-18 Mar 2027 |

| Preparatory Class M1 | 24 April 2026 | 3 July 2026 | 23 October 2026 |

| Preparatory Class M2 | 22 May 2026 | 31 July 2026 | 27 November 2026 |

| Preparatory Class M3 | 19 June 2026 | 4 September 2026 | 15 January 2027 |

| Preparatory Class M4B | 17 July 2026 | 9 October 2026 | 26 February 2027 |

| Preparatory Class M4R | 14 August 2026 | 13 November 2026 | 26 March 2027 |

| Assessment M1 | 30 April 2026 | 9 July 2026 | 29 October 2026 |

| Assessment M2 | 2 June 2026 | 6 August 2026 | 3 December 2026 |

| Assessment M3 | 25 June 2026 | 10 September 2026 | 21 January 2027 |

| Assessment M4B | 23 July 2026 | 15 October 2026 | 4 March 2027 |

| Assessment M4R | 20 August 2026 | 19 November 2026 | 31 March 2027 |