About the Programme

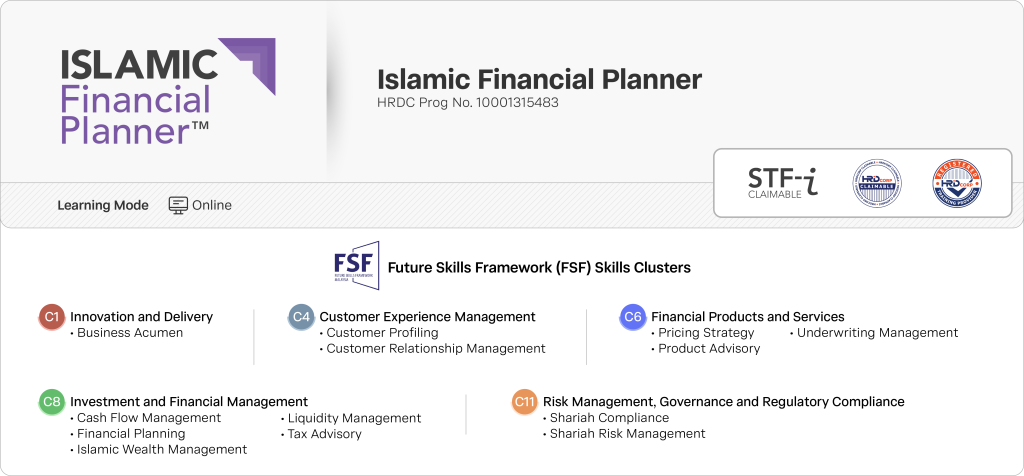

The Islamic Financial Planner (IFP) is a professional qualification programme designed for professionals and executives that serves the retail segment of the Islamic financial market. IFP is pre-requisite for Capital Market Services Representative’s License (CMSRL) by Securities Commission (SC) and Islamic Financial Advisers’ Representative License (FAR) by Bank Negara Malaysia (BNM) to carry out the regulated activity of financial planning. This programme is a joint collaboration between IBFIM and Financial Planning Association of Malaysia (FPAM).

Being certified as an Islamic Financial Planner will equip learners with all the necessary knowledge to serve clients better and to become a financial advisory professional. The IFP programme sets the competency standards and ethical practices of the professionals. In short, the consultants and agents can look forward to a fulfilling and prosperous career of being an Islamic financial planner.

Challenge Status

IFP Challenge Status programme is a fast-track programme for those who are already involved in the related industry and have similar professional qualifications.

Learning Outcomes

At the end of the module, learners should be able to:

- Illustrate the Shariah principles and its applications that related to Islamic financial planning;

- Relate the financial planning industry and its regulatory structure;

- Realise the steps and requirement in Islamic financial planning process;

- Construct and strategise a holistic Islamic financial plan; and

- Formulate and execute implementation and review process of the plan as an ongoing advisory service.

Entry Requirement

- Certified Financial Planner® (CFP®) holders; or

- Other professional certificants e.g. Chartered Financial Analyst® (CFA®), CharteredAccountant (CA) or equivalent with 3 years’ experience; or

- Bachelor’s degree holder in any discipline with 5 years minimum experience in Islamic financial services industry

Assessment

CS: Shariah, Islamic Financial Plan Construction and Professional Responsibilities

Paper 1

• 75 Multiple Choice Questions

• 60% Passing Marks

• Remote Examination (Online)

• 2 Hours 30 Minutes

Paper 2

• Part A – Structured Questions

• Part B – Case Study

• 60% Passing Marks

• Remote Examination (Online)

• 1 Hour 30 Minutes (Pre-Reading) + 3 Hours 30 Minutes

Programme Details

| Programme | Online | Face to face |

| Islamic Financial Planner- Challenge Status HRDC Prog No. 10001444313 Advanced | 42 Hours RM 7,711.20 USD 2,540.16 | 6 days RM 10,335.60 USD 3,414.96 |

| Preparatory Class | 7 Hours RM 1,285.20 USD 423.36 | 1 day RM 1,722.60 USD 569.16 |

| Assessment | 1.5 hours RM 400.00 USD 125.00 | 1.5 hours RM 400.00 USD 125.00 |

| Total | 49 Hours RM 9,396.40 USD 3,088.52 | 7 days RM 12,458.20 USD 4,109.12 |

Programme Date

| Modules | COHORT 1 | COHORT 2 | COHORT 3 |

| CS | 1,2, 15,16,29,30 June 2026 | 1,2,14,15,28,29 September 2026 | – |

| Preparatory Class | 8 July 2026 | 8 October 2026 | – |

| Assessment | 27-28 July 2026 | 26 & 27 October 2026 | – |

For programme enrolment or further enquiries, please email training@ibfim.com or contact +603 2031 1010