About the Programme

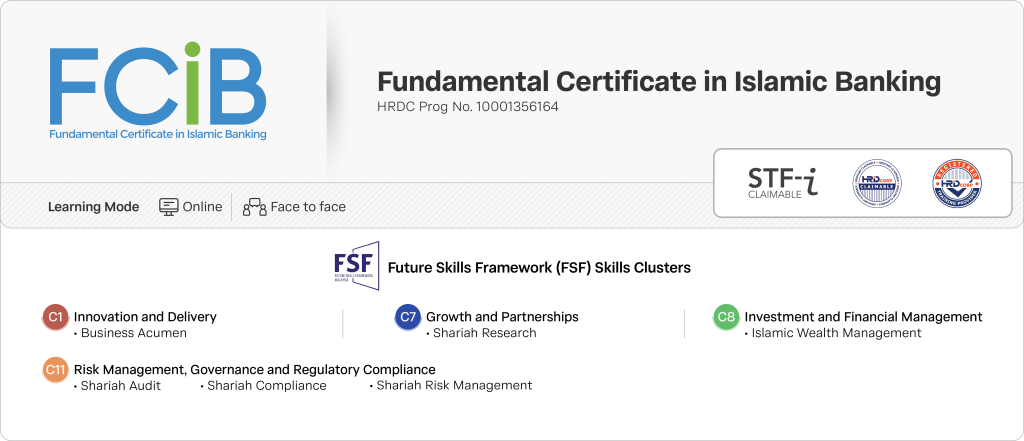

FCIB is designed to ensure that industry practitioners attain the required foundation knowledge in Shariah and Islamic banking. Learners will be equipped with the fundamentals and the applied contracts of Shariah in Islamic finance, as well as the foundation of Islamic banking with an overview of its products and operations.

Learning Outcomes

At the end of the module, learners should be able to:

- Describe the Shariah requirements and prohibitions in Islamic commercial transactions as well as gain a strong foundation in the fundamentals of Shariah contracts;

- Analyse and comprehend the various structures of Islamic financial products and services; and

- Explain the differences between conventional and Islamic finance practices.

Entry Requirement

• Sijil Pelajaran Malaysia (SPM) / O-Level

Assessment

• 50 Multiple Choice Questions

• 60% Passing Marks

• Remote Examination (Online)

• 1 Hour 30 Minutes

Programme Details

| Programme | Online | Face to face |

| M1 Fundamentals of Shariah for Islamic Finance HRDC Prog No. 10001334036 Fundamental | 21 hours RM 3,220.56 USD 1,065.96 | 2 days RM 4,098.60 USD 1,354.32 |

| M2 Fundamentals of Islamic Banking HRDC Prog No. 10001333584 Fundamental | 21 hours RM 3,220.56 USD 1,065.96 | 2 days RM 4,098.60 USD 1,354.32 |

| Preparatory Class | 4 hours RM 613.44 USD 203.04 | 0.5 day RM 683.10 USD 225.72 |

| Assessment | 1.5 hours RM 100.00 USD 95.00 | – |

| TOTAL | 42 hours RM 7,154.56 USD 2,429.96 | 0.5 day RM 8,980.30 USD 3,029.36 |

Programme Date

| Modules | COHORT 1 | COHORT 2 | COHORT 3 |

| M1 | 14-16 April 2026 | 23-25 June 2026 | – |

| M2 | 27-29 April 2026 | 21-23 July 2026 | – |

| Preparatory Class | 8 May 2026 | 31 July 2026 | – |

| Assessment | 13 May 2026 | 6 August 2026 | – |